JACK IN THE BOX, RELAUNCHING ITS FRANCHISING EFFORT

By Gary Occhiogrosso – Founder and Managing Partner – Franchise Growth Solutions

Today I have the pleasure of sharing insights from, Darin Harris the CEO of Jack in the Box. Founded by Robert Peterson in 1951, Jack in the Box is one of the earliest fast-food restaurants. Innovative for its time, the Jack in the Box brand was built with the “drive-thru” in mind. The brand was the first to use a two-way speaker system for its drive-thru ordering. Today the brand continues to evolve as it relaunches its franchising effort to expand into new markets and capitalize on its 70-year history and resilience.

Although today, Jack in the Box operates just over 2,200 locations, there were not many in the New York area when I growing up. However, we were fortunate to have a local Jack in the Box in Flushing, Queens. The iconic brand was a staple in my teenage years. It was very routine to stop in for some tacos and burgers with my buddies after a late night out. I recall Jack in the Box had a unique drive-thru ordering kiosk. It was actually “Jack” popping out of the box, ready to take my order. I remember the clown-faced “Jack” staring at me as my friends and I placed our orders, certainly a challenge if you suffer from Coulrophobia, the fear of clowns.

With prior franchisee disputes settled, Darin Harris, CEO of Jack in Box, reveals the issues and challenges in relaunching the franchising effort. From gaining trust with the existing franchise community to focusing on unit-level economics to a new prototype restaurant, the brand is poised for a franchising reemergence.

Gary Occhiogrosso: You took the reins of Jack in the Box at the onset of the pandemic in April 2020; what drew you to the brand, and what was your initial vision for growth?

Darin Harris: Prior to Jack in the Box, I was CEO of IWG Regus; however, most of my career was spent in the restaurant industry, building brands through franchising, operations, and more. I always noted the potential that Jack in the Box had, and I’m proud of the strides we’ve been able to take so far.

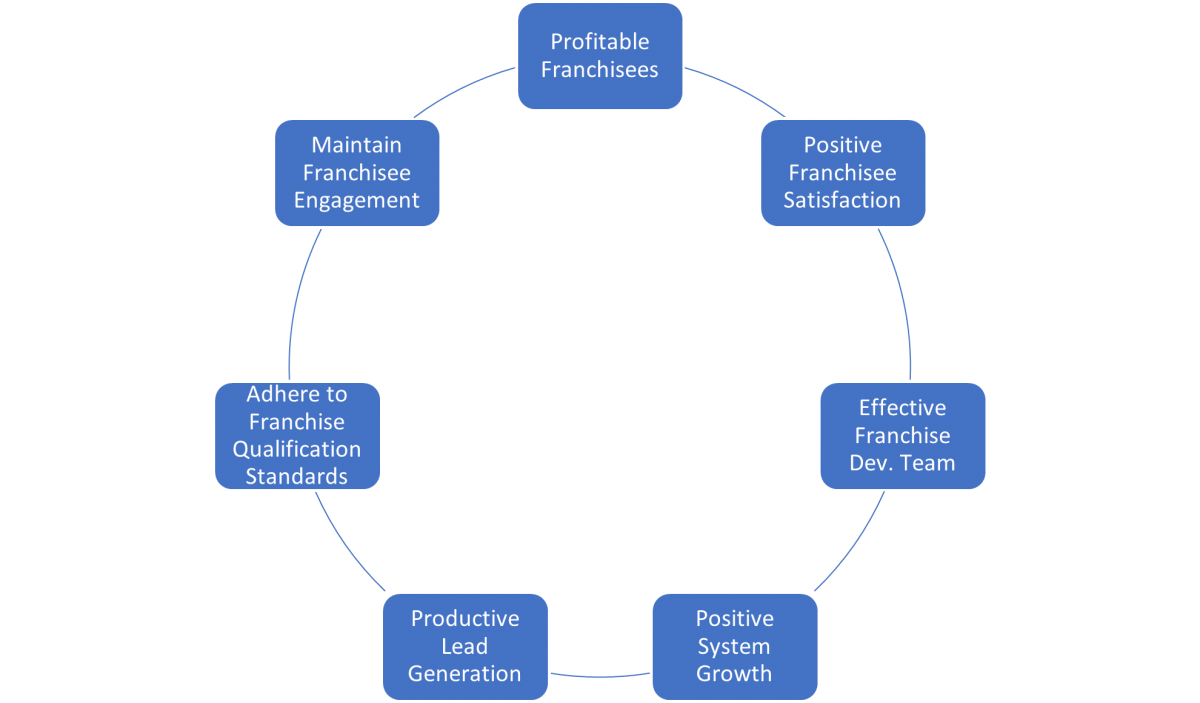

We’re looking to build what I call “Jack’s House,” which starts with our foundation focused on culture, people, innovation, and technology. We really want to shape a caring high-performance culture by serving our people, guests, and franchisees well. We also want to build brand loyalty, drive operational excellence, grow restaurant profits and expand our reach. To do that, we needed to evolve our leadership team. We’ve hired a new CFO, CMO, COO, CPO, and a Chief of Franchise and Corporate Development to help take Jack in the Box to the next level. Additionally, we’ve focused on repairing the franchisor/franchisee relationship and announced the relaunch of our franchise development program earlier this year after a decade of hiatus. All of this creates a blueprint for Jack in the Box’s future, which aims to help grow total revenue, optimize return on invested capital, increase EBITDA, and create long-term shareholder returns.

Occhiogrosso: What were some of the obstacles you faced upon becoming the CEO? How did you prioritize initiatives when taking the helm during such a challenging time for the foodservice industry?

Harris: First and foremost, we needed to rebuild trust with our franchisees. We looked to re-energize our franchisees and develop meaningful relationships with each of them. Our franchisees are our family, and we needed to ensure they felt that way. After speaking with our franchise system and rebuilding the executive team, we looked to relaunch our franchise development program. Current and prospective franchisees have the opportunity to franchise and grow with Jack in the Box following the relaunch of the franchising program. We’re thrilled at the initial response as 2/3rds of our current franchisee network have expressed interest in growing. Prospective franchisees are very interested, as well.

We also needed to focus on unit-level economics, building a development strategy, digital strategy, and refreshing our guest research to ensure we’re meeting guests’ needs. Our four-pillar strategy will help guide us through the execution of each initiative. These include building brand loyalty, driving operational excellence, growing restaurant profits, and expanding our reach as a whole. These driving factors, coupled with the talented leadership team we’ve been able to build over the past several months, have aided my ability to lead every step of the way.

Amid the pandemic, we made a lot of the right decisions to ensure we were meeting our guests where they wanted to be met. Our model has proven to help us through the pandemic, and we’re fortunate that our drive-thru and third-party delivery strategy was executed well to help build sales at our locations. The first year at Jack in the Box has been exciting, and I’ve never had more fun in my career. Our restaurants are successful, and I love the people and personality behind Jack in the Box.

Occhiogrosso: Why was strengthening the franchisee/franchisor relationship important to you from the start? How did you go about doing this?

Harris: I’ve always viewed a company’s franchisees as its partners in strategy, and from the beginning, I knew we needed to re-energize that relationship at Jack in the Box. We cannot succeed unless our franchisees succeed, so it was important to get to know our franchisees and develop those meaningful relationships from day one. Once I accepted the position, I immediately started contacting our franchisees and spoke with about 25 of them. I wanted to hear the challenges they’ve had in the past and how they felt like we could improve, but most importantly, get to know them personally and learn about their families.

At Jack in the Box, we want to constantly strive to ensure our franchisees are equipped with the resources necessary to drive meaningful growth. The franchisee/franchisor relationship has significantly improved, so much so that 66% of our current franchisee network have expressed interest in growing. We’re really excited about the progress we’ve made and look forward to working with our franchisees as we grow in current and new markets.

Occhiogrosso: After Jack’s decade long hiatus from franchising, what motivated you to relaunch the franchise development program?

Harris: Over the past 18 months, we’ve proven that we are pandemic-resistant, and we’re eager to grow with our current franchisee network, as well as prospective owners. In fact, our existing franchisees had been wanting to expand for years, but the timing wasn’t right for corporate. While we currently rank first or second in unit count within our competitive set for 8 of our top 10 existing markets, we know there is a tremendous amount of whitespace to grow in existing and new markets.

The decision to relaunch our franchise development program began with reenergizing our franchisees and building those relationships, as I mentioned earlier. We believe there’s potential for another 1,500 restaurants in our existing footprint alone and 29 states remain untapped. The growth opportunity for Jack is enormous, and to grow, we need to work with our franchisees.

Occhiogrosso: While Jack in the Box is a longstanding brand in the QSR space, the competition in its sector continues to grow. How has the brand managed to report record-breaking sales the past few quarters?

Harris: It’s been an exciting time at Jack in the Box. Our guests are making more premium item purchases, and that helped increase system same-store sales 10.2% in Q3 2021. Franchise same-store sales grew 10.3% in Q3, with a balanced contribution from both average check and transactions. We’ve made the right pivots amid the pandemic and leaned into off-premise and menu innovation to help drive sales, which led to a historic start in 2021. Consumers are also using our mobile app more than ever, with our customer database growing by nearly 60% the since the start of the pandemic. We also launched our first loyalty program recently that consumer have been responding well to.

Another area of focus for us has been driving incremental sales with menu items like Tiny Tacos and our chicken sandwiches and chicken strips, which has helped raise system-wide sales and AUVs.

As we shift toward core premium entrees, we are observing an increase in items per order reflecting larger parties and fueling an increase in the average check. Our quarter over quarter growth has been remarkable to watch, and it’s a privilege to be part of the success. We look forward to building upon this momentum.

Occhiogrosso: Jack in the Box recently rolled out a new low-cost and drive-thru only prototype. How do you and your team plan to implement this new prototype into the development strategy? How does it play into the trends we are currently seeing in QSR dining?

Harris: Jack in the Box was the first major fast-food chain to develop and expand the drive-thru concept, so it’s in our DNA to grow utilizing the drive-thru. Our new prototype is off-premise only, featuring a lane for drive-thru and a lane for online pick-up and third-party delivery. With our drive-thru sales skyrocketing amid the pandemic, and restrictions lifting nationwide, the new prototype aligns with evolving consumer preferences. We believe that as we continue to progress out of the pandemic, off-premise will remain a preferred method of consumption for many of our guests, and we want to ensure we are meeting and exceeding their expectations.

Occhiogrosso: In what ways do you believe the new prototype will accelerate Jack in the Box’s growth?

Harris: The new off-premise prototype is targeting a reduction of development costs by approximately 20%. The first two prototype locations are slated to open in fiscal year 2022. Understanding that consumer trends and demand are evolving, we needed to build a prototype that makes it easier for our guests to access the brand. Off-premise is going to remain a preferred method of consumption for many guests, and this prototype fits their expectations. Additionally, 95% of our stores have at least one of the four major delivery providers (DoorDash, GrubHub, Postmates, Uber Eats), with 80% of them using at least three of the four. With the introduction of our new prototype, we’re committed to a strategy focused on driving delivery and off-premise sales while making our brand more easily accessible to our guests.

We’re excited about this prototype and development in general. In 2020, we opened 27 restaurants—the most in the past 20 years. We’re also looking at the possibility of non-traditional restaurants and signed a deal with Reef Kitchens to open eight dark kitchens. We’re focused on reaching a 4% annual restaurant growth by 2025. The future at Jack in the Box is extremely bright, and we’re thrilled to ramp up development.

My take-away from this interview is simple; the restaurant industry must continue to innovate to meet the ever-changing consumer trends due to a range of issues, from Covid to work habits to generational lifestyles. Darin Harris and the Jack in Box brand continue to be innovative in the Quick Service Restaurant segment.

===============================================

About Darin Harris. He began his role as Chief Executive Officer in June 2020. He was previously CEO of North America for flexible working company, IWG PLC, Regus, North America, from April 2018 to May 2020. Most notably, Harris is the former Chief Executive Officer of CiCi’s Enterprises from August 2013 to January 2018. For just under five years, Harris also served as Chief Operating Officer for Primrose Schools from October 2008 to July 2013. He previously held franchise leadership roles as Senior Vice President at Arby’s Restaurant Group, Inc, from June 2005 to October 2008 and Vice President, Franchise and Corporate Development at Captain D’s Seafood, Inc., from May 2000 to January 2004. He was also a prior franchise operator of multiple Papa John’s Pizza and Qdoba Mexican Grill restaurants from November 2002 to June 2005. Harris has more than 25 years of leadership experience in the restaurant industry encompassing operations, franchising, brand strategy and restaurant development.