We thought that the last twelve months of performance for individual restaurant stocks might give us a hint as to where to focus going forward. Since some of the obviously large stock gains have taken place among those with the heaviest short position, we have focused on the “short interest ratio”, the number of shares sold short divided by the average daily trading volume.

THE RESTAURANT INDUSTRY AT THE PANDEMIC’S ONE YEAR ANNIVERSARY – WHAT NOW?

By Roger Lipton with permission

The last twelve months have been unprecedented, not only from a business/health standpoint, but from a fiscal/monetary standpoint. There has been more governmental stimulus as well as monetary accommodation than ever before, which has floated all kinds of boats. The Dow Industrial Average hit an all time high just this morning, and, though the NASDAQ index has retreated the last month or so, stocks from Apple to Tesla to Gamestop have written a new book in terms of valuation.

Based upon the new $1.9 trillion Covid bill, the likelihood of a new multi-trillion dollar infrastructure bill, as well as the Federal Reserve’s ongoing willingness to buy at least $120B of Treasury securities every month, there is every indication that the above trends will continue.

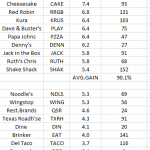

We thought that the last twelve months of performance for individual restaurant stocks might give us a hint as to where to focus going forward. Since some of the obviously large stock gains have taken place among those with the heaviest short position, we have focused on the “short interest ratio”, the number of shares sold short divided by the average daily trading volume. The table just below provides that tabulation, ranked from the highest to lowest current short interest ratio.

From a broad brush, it is shocking to see how large the moves have been from March 8, 2020 until now. It is interesting that several of the best performing “pandemic plays”, namely Domino’s, Wingstop and Papa John’s, which made very big moves over six to nine months, have retraced and are up more modestly now (zero, 56% and 47%, espectively).

This industry, by no stretch of anybody’s imagination is generally in a place that makes these companies “worth” from 50% to 90% more today than they were before the pandemic. There is somewhat less independent competition, and some companies may have learned how to serve off-premise diners better than before, but there are also a great many uncertainties. These include (1) the cost of labor with a new mix of in-store vs. off-premise (2) commodity inflation (3) other expenses to meet health requirements (4) unpredictable consumer spending (5) still substantial competition (6) ongoing high occupancy expenses, especially for new sites. There is also, in many cases, new debt to service.

Fundamentals aside: the stocks have done the following, ranked by today’s short interest ratio.

What do we see? The average gain among the fourteen stocks with the highest short interest ratio is 90%. The bottom fourteen stocks went up by 57%. Without our focus on individual company fundamentals, readers can scan the list and conclude for themselves which stock performance is most removed from the fundamental outlook.

Where do we go from here?

Before considering the above noted $1.9 trillion Covid bill and trillions more for infrastructure, the Treasury is sitting on $1.44 trillion (to be reduced to $500B by June 30th) that was returned from the Fed last year and the Fed is currently creating $120 billion per month. This means that almost $1.5 trillion of accommodation will be provided to the economy and the markets by June 30th, before the effect of the new $1.9 trillion. This also means that equities, including restaurant stocks, may well go a lot higher in the short term. There is just too much liquidity in the capital markets.

THE BOTTOM LINE

For investors: Other things equal, we would focus on the top portion of the table above. 90% is better than 57%

For companies: In almost all cases, we would sell company stock. Pay down debt and/or build your cash balance. It may be a long time before you see these valuations again.

For management: Lighten up. You can always grant yourselves some more stock options.

==================

About Roger Lipton

Roger is an investment professional with over 4 decades of experience specializing in chain restaurants and retailers, as well as macro-economic and monetary developments. After earning a BSME from R.P.I. and MBA from Harvard, and working as an auditor with Price, Waterhouse, he began following the restaurant industry as well as the gold mining industry. While he originally followed companies such as Church’s Fried Chicken, Morrison’s Cafeterias and others, over the years he invested in companies such as Panera Bread and shorted companies such as Boston Chicken (as described in Chain Leader Magazine to the left) .

He also invested in gold mining stocks and studied the work of Harry Browne, the world famous author and economist, who predicted the 2000% move in the price of gold in the 1970s. In this regard, Roger has republished the world famous first book of Harry Browne, and offers it free with each subscription to this website.