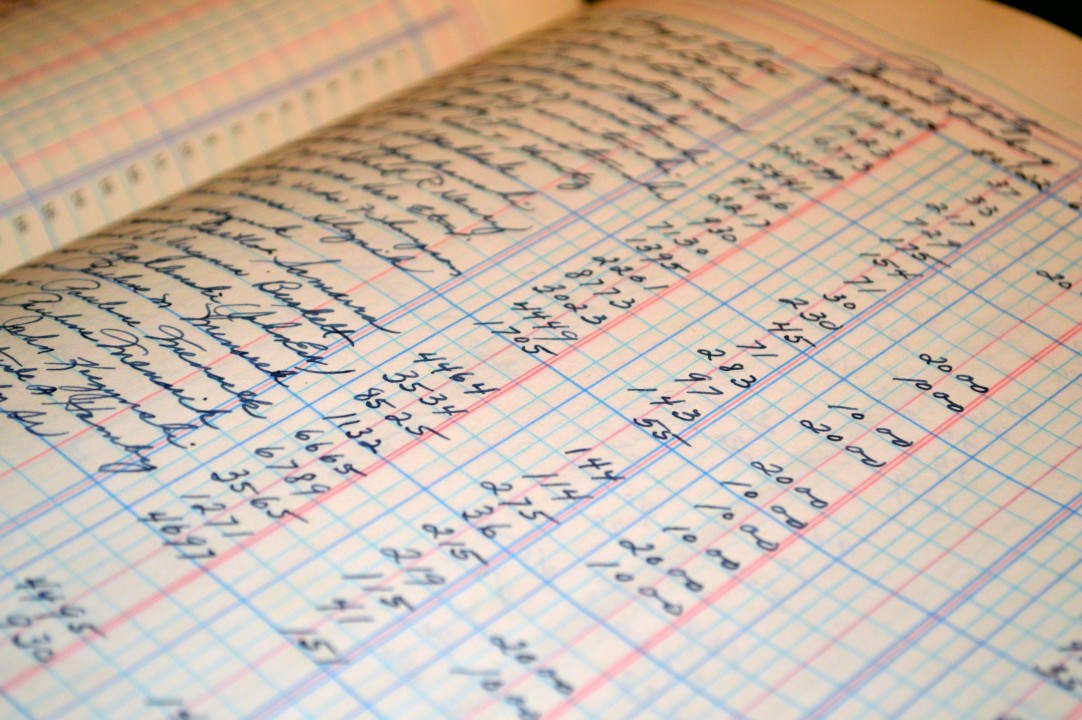

Photo by KirstenMarie on Unsplash

While the franchising pathway offers a compelling roadmap, the journey’s richness and rewards are magnified for those who approach it with a blend of adherence to proven strategies and a commitment to personal growth and dedication. The terrain is fertile; the question is, are you prepared to cultivate it to its fullest potential.

15 Key Strengths of Successful Franchise Owners

Stepping into the world of franchising can be both exciting and intimidating. While franchises promise a proven business model and established brand recognition, only some are considered successful franchisees. What differentiates those who soar in the franchising universe from those who stumble? Here are some key strengths of successful franchise owners:

Firstly, let’s talk about the excitement it brings. Franchises come equipped with a tried-and-tested business model. This model has been refined over time, often through trial and error, to reach a formula that works. For potential franchisees, this means a significant reduction in startup risk. Instead of navigating the uncertain waters of establishing a brand from scratch, franchisees can build upon a foundation that withstands market challenges.

Moreover, there’s the undeniable advantage of brand recognition. Established franchises usually have a loyal customer base, effective marketing strategies, and brand loyalty that new businesses could only dream of. Joining a franchise means buying into an existing reputation — a name that customers already know, trust, and prefer.

But with these advantages come challenges and pressures. The very nature of franchising — which revolves around replicating success — requires an ability to adhere to standards and maintain brand consistency. It’s not just about riding on the brand’s coattails; it’s about upholding and furthering its legacy.

The reality is stark: only some are suited for this journey. While the path is well-trodden, it still demands specific skills, temperament, and business acumen. The franchising universe is vast, and while many soar, capitalizing on the strengths of their chosen franchise and their personal business prowess, others stumble. These missteps can arise from various factors, ranging from a lack of understanding of the brand’s ethos to inadequate managerial skills.

So, what differentiates successful franchise owners from those who find themselves overwhelmed? What are the intrinsic qualities and learned skills that mark the difference between thriving and merely surviving in the world of franchising? As we delve deeper, we’ll uncover the key strengths and attributes that successful franchise owners often possess.

Adherence to Systems and Processes: One of the primary advantages of owning a franchise is the blueprint it provides. Successful franchisees understand the importance of adhering to the franchisor’s proven systems and processes. Trying to reinvent the wheel or straying too far from the established model can lead to inconsistency and potentially harm the brand’s reputation.

Effective Communication Skills: As a franchise owner, you’ll need to communicate with various stakeholders—your employees, customers, suppliers, and, of course, the franchisor. Effective communication ensures you understand and can execute the franchisor’s vision while also addressing the needs and concerns of your staff and customers.

Financial Prudence: A keen understanding of finances is essential. While the franchisor provides a business model, the franchisee must manage expenses, understand cash flow, and make informed decisions that ensure profitability.

Flexibility and Adaptability: The business environment is ever-evolving. Successful franchisees are those who can adapt to changes—whether those are tweaks to the franchise system or more significant market shifts. Being too rigid can mean missed opportunities or potential pitfalls.

Strong Work Ethic: Owning a franchise isn’t a ticket to Easy Street. It requires dedication, long hours, and a commitment to excellence. Successful franchise owners are often the first to arrive and the last to leave, especially in the early days.

Leadership Ability: As the leader of your franchise unit, your team will look to you for guidance, support, and motivation. Influential leaders inspire their employees, foster a positive workplace culture, and are adept at conflict resolution.

Customer Service Focus: Its customers are at the heart of any successful franchise. Understanding the importance of exceptional customer service and ensuring every team member embodies this principle can set your franchise apart and foster loyalty among patrons.

Continuous Learning: The business world, technology, and customer preferences constantly change. Successful franchisees have a thirst for knowledge. They attend the franchisor’s training sessions, seek out additional educational opportunities, and stay abreast of industry trends.

Networking Skills: Building relationships with other franchisees can offer a wealth of knowledge and support. Sharing experiences, challenges, and solutions can provide fresh perspectives and strategies for overcoming obstacles.

Resilience and Perseverance: Every business, including franchises, faces challenges. The ability to remain resilient, stay the course during tough times, and learn from failures is a hallmark of successful franchise owners.

Ethical and Integrity-driven: Trust is foundational in business. Successful franchise owners operate with high levels of integrity, both in dealings with the franchisor and their customers. This engenders trust and fosters long-term relationships.

Decision-making Skills: Being decisive yet thoughtful is crucial. Successful franchise owners evaluate situations, consider the pros and cons, consult when necessary, and then take action.

Problem-solving Ability: No matter how well-laid your plans, problems will arise. The most successful franchisees can think on their feet, approach challenges with a solution-oriented mindset, and seek innovative solutions when faced with obstacles.

Passion and Enthusiasm: Loving what you do is a force multiplier. When you’re passionate about your franchise, that enthusiasm is infectious. It motivates your team, attracts customers, and can see you through the challenging times.

Understanding of Local Market: Every region or locality has its unique characteristics. While the franchisor provides a general business model, understanding local preferences, culture, and dynamics can give you an edge.

Wrapping Up: The Balanced Approach to Franchising Success

Embarking on a franchise venture undoubtedly presents a siren song for many entrepreneurs. The allure of diving into a business with a proven framework, brand recognition, and established operational procedures is, understandably, a tempting proposition. However, while this foundation provides a solid starting point, true success within the franchising sphere demands more.

It’s crucial to understand that merely riding the coattails of a franchise’s previous success isn’t a guarantee for individual achievement. Instead, thriving in this domain requires a delicate balance. Successful franchise owners seamlessly integrate the tested strategies and guidelines the franchisor sets while injecting their personal touch, insights, and strengths. This symbiotic relationship ensures that the franchise maintains its essence – the brand consistency customers have grown to trust – while allowing room for adaptability, innovation, and local nuance.

A self-assessment is a wise starting point if you’re mulling over the prospect of becoming a franchise owner. Reflect upon your current skill set, strengths, and areas needing refinement or further development. Such introspection will provide clarity and pinpoint where additional training, guidance, or mentorship might prove beneficial.

Furthermore, recognize that this journey, like all entrepreneurial endeavors, requires unwavering dedication. It’s not a passive investment but an active pursuit. The world of franchising, with its mix of established methodologies and opportunities for individual innovation, is ripe with potential. But, like any orchard, the sweetest fruits are reserved for those who know where to look and are prepared to nurture, tend, and invest time and effort.

In summation, while the franchising pathway offers a compelling roadmap, the journey’s richness and rewards are magnified for those who approach it with a blend of adherence to proven strategies and a commitment to personal growth and dedication. The terrain is fertile; the question is, are you prepared to cultivate it to its fullest potential.

==============================================

This article was researched, developed and edited with he support of AI